BEE Ownership, Employee Ownership (ESOP), Competition Commission, Multinational BEE

7 min read

By Shaun Smit | 8 January 2024

Employee Share Ownership Plans (ESOPs) involve providing targeted employees with an ownership stake in their employing company. Employee ownership can better align employee and shareholder interests, and from a BEE perspective enables BEE ownership recognition. Companies considering ESOP implementation need to be clear on their objectives, understand available ESOP options and identify the optimal ESOP structure that makes business sense.

Research has identified numerous benefits of ESOPs, both to the implementing company and employees. ESOP aligns the interests of employees and shareholders towards profitability and value creation, as well as creates a sense of ownership in the business by employees.

In the South African context of high economic inequality, employee ownership also promotes economic transformation and broader participation in the economy. ESOPs also provide an opportunity for businesses to improve their Broad-based Black Economic Empowerment (“BEE”) status through being able to recognise black ownership in the business through the ESOP.

In a 2021 practice note, the Department of Trade Industry and Competition (“DTIC”) confirmed the feasibility of ESOPs as an approach to address BEE ownership, which echoes previous comments from the minister as well as statements by the governing party.

If you are considering implementing an ESOP, it is crucial that you are clear on your objectives, understand what the available options are, and identify the optimal ESOP structure that makes the most sense for your business. One size does not fit all.

As a specialist ESOP and BEE transaction advisor to multinationals and South African corporates, Transcend Capital has advised on over 200 transactions since 2005, including various ESOPs at unlisted and listed level. Our in-depth understanding of employee ownership complexities, together with our proven corporate finance expertise and understanding of the regulatory environment means we can combine best practice with innovative thinking in finding sustainable and BEE compliant ESOP solutions.

We are unique among services providers in that we provide full turnkey ESOP solutions. We have an in-depth understanding of the employee ownership process from the perspective of the scheme founder and the employee beneficiaries, allowing us to design workable ESOP structures, and create optimal communication programmes that manage employee expectations.

One of the key drivers of ESOP implementation in South Africa has been the ability to achieve positive BEE ownership outcomes in a way that provides related economic benefit ‘closer to home’ – benefitting the employees that supported business success.

A well-structured ESOP provides an opportunity to better align the interests of employees and shareholders by rewarding both groups of stakeholders for improving business performance and increasing the value of the business. Research on employee ownership has shown that there is most often higher organisational commitment by employees participating in ESOPs.

Employee ownership can also improve employee relations, as well as improve employee attraction and retention, with a related positive impact on business performance. With the skills shortage in South Africa, the ability to attract talent, reduce employee turnover as well as retain star performers is very valuable.

Successful ESOPs provide meaningful financial benefits to participating employees. Beyond increased personal wealth, from a socio-economic perspective, this increased wealth across a broad base increases economic activity and stimulates growth, which is ultimately good for South Africa as a whole.

ESOPs can be structured in many different ways and can range from being structurally simple to complex. Some schemes focus on dividend participation, some have fixed terms of life, and some are structured to be evergreen. Some “ESOPs” do not involve shareholding but involve options or phantom share schemes. While these may achieve similar goals, BEE recognition outcomes may be limited.

It is important to be clear on your objectives, to consider what the available options are and what makes most sense for your business given your specific circumstances and needs.

The table below sets out common structural features for ESOP:

ESOPs can be structured in many different ways and can range from being structurally simple to complex. Some schemes focus on dividend participation, some have fixed terms of life, and some are structured to be evergreen. Some “ESOPs” do not involve shareholding but involve options or phantom share schemes. While these may achieve similar goals, BEE recognition outcomes may be limited.

ESOPs can be structured in many different ways and can range from being structurally simple to complex. Some schemes focus on dividend participation, some have fixed terms of life, and some are structured to be evergreen. Some “ESOPs” do not involve shareholding but involve options or phantom share schemes. While these may achieve similar goals, BEE recognition outcomes may be limited.

It is important to be clear on your objectives, to consider what the available options are and what makes most sense for your business given your specific circumstances and needs.

The table below sets out common structural features for ESOP:

|

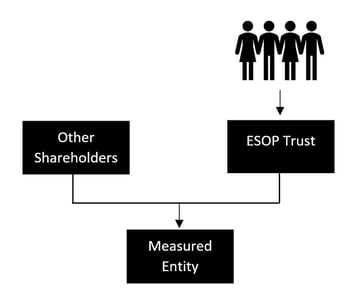

Legal structure |

Trust holding shares in employing company/group. |

|

Fiduciaries |

Trustees, which include founder/employer representation and employee representation. |

|

Participants |

Eligible employees, with eligibility rules being tailored by the founder to suit the desired scheme outcomes. ESOPs can be tailored for targeted segments of the workforce eg. senior management; or all employees up to management level. |

|

ESOP term |

Either fixed-term or evergreen with termination at option of founder. |

|

Funding |

Typically, interest-bearing vendor funding from the founder, often at a discount to fair value. Funding is secured by ESOP shareholding, with some dividends being applied to loan repayment. Notional vendor funding structures are fairly common. |

|

Manner of benefit |

Manner of benefit is determined by chosen ESOP structure, taking targeted employee participants into account. Typically employees either benefit through dividend participation or in the gain in net asset value of ESOP transactions over a defined vesting period.

Employees most often do not own shares, but rather benefit as unit-holding beneficiaries of trust. |

|

Termination of employment |

‘Good leaver’ vs ‘bad leaver’ rules, with good leavers being entitled to unvested value linked to their participation and bad leavers forfeiting value. |

Employee ownership is specifically recognised in the BEE Codes of Good Practice as one of the vehicles to address BEE ownership, with bonus points being available if a qualifying ESOP is implemented.

The African National Congress’s 2019 election manifesto expressed the need to broaden ownership of the economy and that a related focus should be ‘on extending worker ownership across the sectors of the economy’.

In early 2021, Trade, Industry and Competition Minister, Ebrahim Patel, stated that a vital element of broad-based transformation includes bringing workers into the ownership and representative structures of companies. A Practice Note issued by the DTIC in 2021 re-iterated that ESOPs support broad-based transformation, and can be used to achieve BEE ownership recognition.

The BEE Commission, tasked with over-seeing and promoting adherence with the BEE Act, has previously raised some concerns regarding broad-based ownership schemes in general, but specifically had some concerns regarding ESOPs. These primarily appeared to be regarding the ability to have an evergreen (non-terminating) ESOP as well as the role of fiduciaries (eg. trustees) versus participants in decision-making. The above-mentioned Practice Note addressed these issues, and confirmed that evergreen ESOPs are acceptable, and that fiduciaries most often make decisions on behalf of the beneficiaries that they are acting in the interest of.

In order for BEE ownership to be recognised via an ESOP, various requirements have to be met.

The table below sets these out:

|

Aspect |

Requirement |

|

Fiduciaries (eg. trustees for a trust) |

Employee participants must appoint at least 50% of the trustees. |

|

Beneficiaries |

The scheme constitution (eg. trust deed) must define the employee participants and their proportion of claim to receive distributions.

Fiduciaries must have no discretion in the determination of the definition of participants or of the proportion of claims to receive distributions. |

|

Operation and governance |

In order to achieve maximum points on the ownership scorecard, a track record of operating as an ESOP is required, or in the absence of such record then demonstrable evidence of full operational capacity to operate as an ESOP. |

|

Provision of information to, and engagement with participants |

The fiduciaries must present the financial reports of the ESOP at a scheme annual general meeting.

Participants must be able to participate in managing the scheme at a level similar to the management role of shareholders in a company. The scheme constitution must be available, on request, to any employee participant in an official language with which that person is familiar. |

|

On termination |

All accumulated economic interest is payable to the participants at the earlier of the date or event specified in the deed or on termination or winding up of the ESOP. |

Through ESOP implementation it is important to ensure that the scheme structurally meets your needs and is BEE compliant.

While the ANC government has expressed support for ESOPs, this is yet to meaningfully carry through in the tax treatment of ESOPs.

Based on our experience, there is no tax deductibility for companies implementing traditional ESOPs. From the employee participant perspective, ESOP participation is most often viewed as restricted equity instruments, and ESOP pay-outs on vesting being treated as fully taxable income in the participants’ hands. In addition, it is important to manage the timing of receipts by the scheme itself, and on-distribution to employee beneficiaries to avoid any adverse tax implications.

It is important to be clear on the tax treatment of a proposed ESOP structure, as it can be complex and there may be opportunity to achieve similar outcomes in a more tax advantageous manner.

In our experience, ESOPs are most often accounted for as a ‘share-based payment’ under IFRS2, whereby the ESOP investment is viewed as an option. Depending on the scheme structure, the ESOP will be accounted for as an “equity-settled transaction” or a “cash-settled transaction”.

As equity-settled, an entity recognises a cost and corresponding entry in equity, based on the initial option valuation at the grant date. There is no annual revaluation.

As cash-settled, an entity recognises a cost and corresponding liability, based on the initial option valuation at the grant date. There is then annual revaluation to address changes in expected and actual outcomes.

Understanding the accounting implications of a proposed ESOP for employer and potentially on consolidation is important.

Based on outcomes of Competition Commission engagement for various mergers and acquisitions, it appears that there is increased consideration of the “public interest” grounds of any deal. In terms of “public interest”, among other things, the Competition Commission considers the promotion of a greater spread of ownership, in particular the levels of ownership by historically disadvantaged persons as well as workers.

Various deals have included an ESOP component, including Burger King; Coca-Cola Beverages; AB InBev; and PepsiCo. Based on engagement with the Competition Commission, ESOPs appear to be a favoured approach to achieving “public interest”, and are often included as a condition for approval.

Critical to sustainable ESOP success is managing employee and, if relevant, union expectations. This can be best achieved through training and communication regarding scheme rules, business value drivers, and where necessary, basic financial literacy.

A well-designed communication programme supported by interactive participant sessions and easily understandable communication materials has a major positive impact on ESOP acceptance (reducing scepticism) as well as participants knowing what to expect, and when.

Of equal importance is ensuring that the trustees are empowered to confidently fulfil their fiduciary role. This requires that they have a good understanding of the ESOP workings, the business and drivers of success, as well as the role, duties and responsibilities of a trustee. This can be achieved through in-depth trustee training.

ESOPs provide an attractive option to address BEE ownership in a way that can achieve various other benefits at the same time.

If you are considering an ESOP for your business, it is imperative to critically investigate and analyse the structural options and related implications in order to identify what makes most sense for your business, while ensuring BEE compliance.

To best managing employee expectations, simple and effective ESOP communications are important, together with trustee training.

With over 15 years of experience in turnkey ESOP implementation, Transcend Capital can support you on your journey in finding an optimal and sustainable ESOP solution.

Shaun Smit

7 min read

7 min read